Jump to page sections

Date of publishing: 2022-01-26. Last update: 2022-01-26.Grantham's Three Super Bubbles of 2022

Yesterday, I read that the first 16 trading days in the US represented the worst start to the year ever in American history, based on the S&P500 index development.

A man with 83 years of experience, the investor veteran Jeremy Grantham, has made some gloomy predictions. He says there are currently three financial super bubbles in the American economy.

A bubble is defined as a deviation from a trend that is equivalent to double the normal variation, while a super bubble is when there is a difference of three times the normal variation. Variation is defined against the statistical concept of standard deviation.

The Bubbles

- Property prices are higher than ever in history compared to household income. The property bubble is bigger now than the one in 2006, which led to what we know as "the financial crisis".

- We have the most enthusiastic, ecstatic and indeed craziest behaviour ever seen in the history of the American stock markets. The thought that stocks can only rise in value has, in Grantham's opinion, never been stronger in the American markets than today. And this is the essence of a bubble. (Meme version: "Stonks only go up").

- Bonds have not been more expensive, and the interest rates correspondingly lower, ever in history.

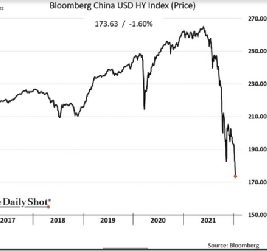

Chinese High Yield Graph

Graph from January 15, 2022.

In other words, this fountain of wisdom, that has been filling for 83 years, sees big problems. I remind myself that problems have solutions, so we should not despair. We will find solutions. But Grantham's conclusion is: Property super bubble, stock market super bubble and bonds/interest super bubble. Ominous to observe.

In addition to that, he talks of a bubble within raw goods. Food prices are high globally, for instance, but he does not see this as a bubble yet. He calls it a "half bubble".

One year ago, Grantham warned that the USA was entering the final stages of a stock market bubble. From the time that was published - on January 5, 2021 - the S&P500 index rose 20 % (22 % with dividends). People who listened to Grantham back then missed out on 20 % profits before the recent development.

Grantham has an interesting definition of what is known as a "successful bear market call". One that shows acumen: "Plainly and simply, it's that an investor will, sooner or later, be happy to have stayed outside the stock market. He will have saved money on not being invested and reducing risk or volatility by going in and out. This definition of success does not include a precise timing." (This was translated from English to another language and back; apologies for any inaccuracies.)

The broader stock market is not a bear market at this point, meaning down 20 % or more, but for the riskier stocks, such as the riskier tech stocks (down 39 %) and expensive software companies (down 23 %), the prediction already rings true. The popular "Ark" fund is down well over over 40 % since Grantham's warning in January 2021 at the time of writing.

This is the nature of stock bubbles. The riskiest stocks soar the most, but are also first to fall when the bubble bursts. Risk/reward is a well-known concept, but a lot of newcomers are just now learning about this - many the hard way.

Grantham gives the US Federal Reserve a large part of the blame. He calls former Fed boss Alan Greenspan "dangerously incompetent", because he in the 90's created the notion, in investors, that the Fed would rescue them if the markets collapsed.

Now the Fed has three simultaneous bubbles to handle. Grantham says "If this negative wealth and income effect is amplified by inflation from energy, food and other supply chain problems, we will be in serious economic problems."

Let's hope for the best. I am. I will just do my small part while life keeps unfolding, to the best of my abilities. One thing I take comfort in, is that (at least short- and mid-term) the sum of people and goods on the planet is exactly the same as it was before the financial crisis. The resources are the same. It's a systemic problem. The day before stock markets crash 20 % - and the day after - not much changed except numbers in a "game". There's a point here that I have problems stating clearly. Maybe you understand what I mean.

Of course, circumstances are peculiar in the midst of a pandemic and fiscal houses of cards. The pandemic affects supply chains in ways not seen before in modern times. If we enter a recession, somehow the numbers game that is our economy plays a great role in making life potentially suck for a lot of people, but we are still alive and most of us with roughly the same health, generally speaking, as the day before, or the month before.

To the US Federal Reserve, I can only advise to not panic (not that my opinion is of great significance). And, please, do not over-spend. Accept that it will happen, to some degree. We will recover - and eventually soar again. Human wisdom is growing. If only motivation and (moral) direction match the increase in knowledge, we can make a great society together. The heart of life is good. We must fight chaos. We know the difference between good and evil, and it is our duty before God/humankind/the biosphere to do good.

The upside, for us who mostly have stayed out of the markets, is that we can invest in stocks at more reasonable prices. But the overall well-being of humankind (and animals!) concerns me much more than the personal financial numbers on the screen that don't directly change my life, given my situation. Unfortunately, if you are somewhat egalitarian-minded, the differences in society increase during the "uprising" of the stock markets. With property, differences are less prevalent.

Be good so you deserve to be well.

Finance Finans Stocks Mutual Fund SnP500 DowJones Politics Aksjer QE Quantitative Ease NASDAQ Corona Investing High-level_nonsense Macro EconomicsBlog articles in alphabetical order

A

- A Look at the KLP AksjeNorden Index Mutual Fund

- A primitive hex version of the seq gnu utility, written in perl

- Accessing the Bing Search API v5 using PowerShell

- Accessing the Google Custom Search API using PowerShell

- Active directory password expiration notification

- Aksje-, fonds- og ETF-utbytterapportgenerator for Nordnet-transaksjonslogg

- Ascii art characters powershell script

- Automatically delete old IIS logs with PowerShell

C

- Calculate and enumerate subnets with PSipcalc

- Calculate the trend for financial products based on close rates

- Check for open TCP ports using PowerShell

- Check if an AD user exists with Get-ADUser

- Check when servers were last patched with Windows Update via COM or WSUS

- Compiling or packaging an executable from perl code on windows

- Convert between Windows and Unix epoch with Python and Perl

- Convert file encoding using linux and iconv

- Convert from most encodings to utf8 with powershell

- ConvertTo-Json for PowerShell version 2

- Create cryptographically secure and pseudorandom data with PowerShell

- Crypto is here - and it is not going away

- Crypto logo analysis ftw

D

G

- Get rid of Psychology in the Stock Markets

- Get Folder Size with PowerShell, Blazingly Fast

- Get Linux disk space report in PowerShell

- Get-Weather cmdlet for PowerShell, using the OpenWeatherMap API

- Get-wmiobject wrapper

- Getting computer information using powershell

- Getting computer models in a domain using Powershell

- Getting computer names from AD using Powershell

- Getting usernames from active directory with powershell

- Gnu seq on steroids with hex support and descending ranges

- Gullpriser hos Gullbanken mot spotprisen til gull

H

- Have PowerShell trigger an action when CPU or memory usage reaches certain values

- Historical view of the SnP 500 Index since 1927, when corona is rampant in mid-March 2020

- How Many Bitcoins (BTC) Are Lost

- How many people own 1 full BTC

- How to check perl module version

- How to list all AD computer object properties

- Hva det innebærer at særkravet for lån til sekundærbolig bortfaller

I

L

M

P

- Parse openssl certificate date output into .NET DateTime objects

- Parse PsLoggedOn.exe Output with PowerShell

- Parse schtasks.exe Output with PowerShell

- Perl on windows

- Port scan subnets with PSnmap for PowerShell

- PowerShell Relative Strength Index (RSI) Calculator

- PowerShell .NET regex to validate IPv6 address (RFC-compliant)

- PowerShell benchmarking module built around Measure-Command

- Powershell change the wmi timeout value

- PowerShell check if file exists

- Powershell check if folder exists

- PowerShell Cmdlet for Splitting an Array

- PowerShell Executables File System Locations

- PowerShell foreach loops and ForEach-Object

- PowerShell Get-MountPointData Cmdlet

- PowerShell Java Auto-Update Script

- Powershell multi-line comments

- Powershell prompt for password convert securestring to plain text

- Powershell psexec wrapper

- PowerShell regex to accurately match IPv4 address (0-255 only)

- Powershell regular expressions

- Powershell split operator

- Powershell vs perl at text processing

- PS2CMD - embed PowerShell code in a batch file

R

- Recursively Remove Empty Folders, using PowerShell

- Remote control mom via PowerShell and TeamViewer

- Remove empty elements from an array in PowerShell

- Remove first or last n characters from a string in PowerShell

- Rename unix utility - windows port

- Renaming files using PowerShell

- Running perl one-liners and scripts from powershell

S

- Sammenlign gullpriser og sølvpriser hos norske forhandlere av edelmetall

- Self-contained batch file with perl code

- Silver - The Underrated Investment

- Simple Morningstar Fund Report Script

- Sølv - den undervurderte investeringen

- Sort a list of computers by domain first and then name, using PowerShell

- Sort strings with numbers more humanely in PowerShell

- Sorting in ascending and descending order simultaneously in PowerShell

- Spar en slant med en optimalisert kredittkortportefølje

- Spre finansiell risiko på en skattesmart måte med flere Aksjesparekontoer

- SSH from PowerShell using the SSH.NET library

- SSH-Sessions Add-on with SCP SFTP Support

- Static Mutual Fund Portfolio the Last 2 Years Up 43 Percent

- STOXR - Currency Conversion Software - Open Exchange Rates API